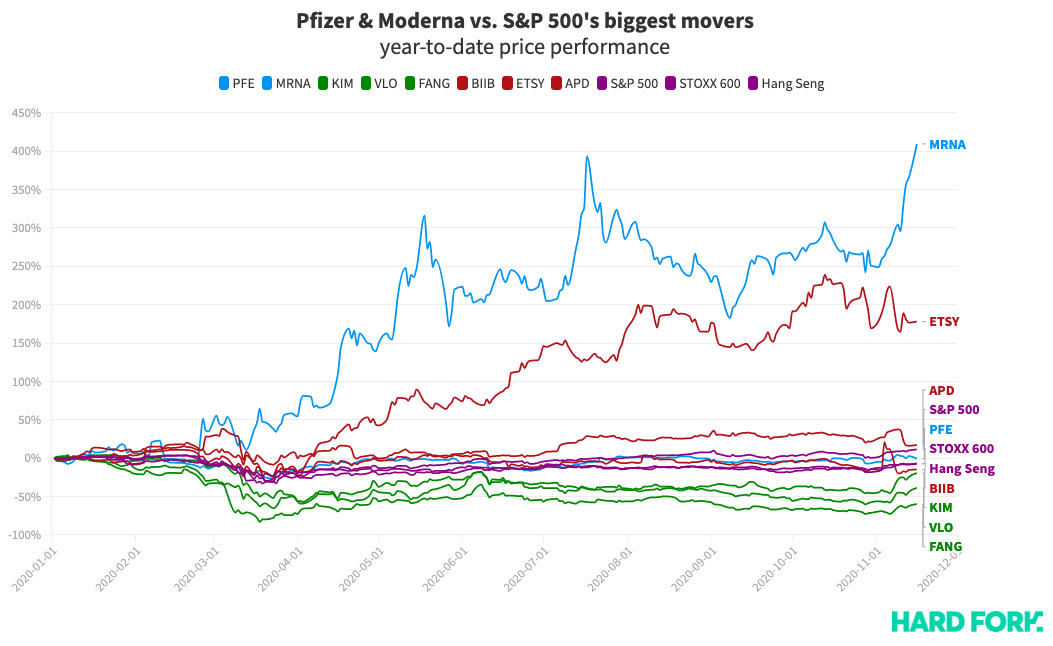

Potential COVID-19 vaccines touted by pharmaceutical giants Pfizer and Moderna have upturned markets over the past 10 days, with investors flocking to stocks that might benefit from a potential return to normal life.

In fact, companies in the S&P 500 have added more than $1 trillion to their market values since Pfizer’s announcement, and both the Dow and the S&P set new record highs directly following Moderna’s tease on Monday.

Stocks hailing from the financials, industrials, and energy sectors have contributed the bulk of those gains so far, at least in terms of raw dollar value.

(If the visualizations on this page don’t show, try reloading this page in your browser’s “Desktop Mode”.)

Led by Warren Buffett’s Berkshire Hathaway, finance companies in the S&P 500 grew by more than $324 billion between November 6 and November 16, while the energy sector added $135 billion — a 24% rise in 10 days.

Buoyed by a stock portfolio that boasts some of the more bullish stocks like American Express, Berkshire stock is up 11% and now positive for the year.

Berkshire’s currently worth $542 billion, having grown by $58 billion after Pfizer and Moderna revealed the positive results of their individual vaccines trials.

[Read: Traders dump Zoom for Expedia as Pfizer vaccine teases life after COVID]

Energy, real estate stocks pumped way more on COVID vaccine news

Shopping centre kingpin Kimco Realty’s share price has risen 44%, transportation fuelers Valero is up 40%, as is hydrocarbon exploration company Diamondback.

As for the S&P’s biggest market value losers in the face of a potential return to normal, tech and ecommerce companies are the hardest hit.

Amazon is down more than $90 billion, while Microsoft and Nvidia have respectively lost $49 billion and $26 billion thanks to price drops of more than 5%.

However, biotech stock Biogen (BIIB) has suffered the worst price collapse of the stocks analyzed by Hard Fork, having fallen 24% between November 6 and November 16.

But rather than COVID, Biogen’s struggles have instead been attributed to its recent failure to achieve FDA approval for its new drug for Alzheimer’s.

Arts and crafts marketplace Etsy (ETSY) and industrialists Air Products & Chemicals (APD) were next, with each stock having fallen by around 12%.

Get the TNW newsletter

Get the most important tech news in your inbox each week.